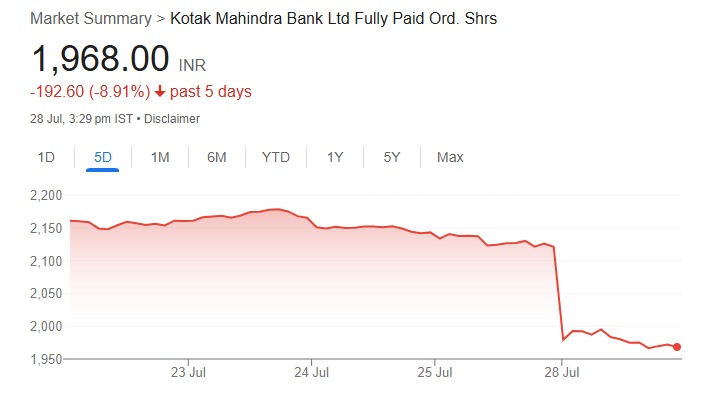

Kotak Mahindra Shares Fall Over 7%: A Deep Look into Financial Performance and Market Sentiment

Kotak Mahindra Bank becomes one of the top losers on the Nifty 50 as stock slips 7.44%; we explore what’s behind the drop and how the bank has performed financially.

On Monday, shares of Kotak Mahindra Bank fell sharply by 7.44%, closing at Rs 1,966.60 on the NSE. This made it one of the top losers on the Nifty 50 index for the day. The sudden fall caught the attention of investors and market watchers, raising questions about the bank’s recent financial performance and its outlook.

Let’s take a closer look at the numbers and what they reveal.

Financial Snapshot: 5-Year Growth Overview

Kotak Mahindra has shown consistent growth over the last five years. Here are some key highlights:

- Net Profit increased from Rs 9,903 crore in 2021 to Rs 21,946 crore in 2025.

- Earnings Per Share (EPS) jumped from Rs 50.53 in 2021 to Rs 111.29 in 2025.

- Book Value Per Share (BVPS) rose from Rs 425.56 to Rs 792.11.

- Return on Equity (ROE) improved gradually from 11.84% to 14.04%.

- Net Interest Margin (NIM) slightly fluctuated, settling at 4.25% in 2025.

This shows a steady performance, but short-term factors seem to be affecting the stock price.

Quarterly Performance: June 2025 vs June 2024

The fall in Kotak’s stock may be linked to its quarterly earnings for June 2025, which showed a decline:

| Particulars | June 2024 | June 2025 |

|---|---|---|

| Net Profit | Rs 7,399 crore | Rs 4,429 crore |

| EPS | Rs 37.47 | Rs 22.49 |

This is a significant drop from the same quarter last year. Lower profit and EPS figures are likely responsible for the negative investor sentiment.

Yearly Performance: Net Profit & EPS

The annual growth story still looks strong:

| Year | Net Profit (Rs crore) | EPS |

|---|---|---|

| 2021 | 9,903 | 50.53 |

| 2022 | 11,932 | 60.76 |

| 2023 | 14,780 | 74.96 |

| 2024 | 17,977 | 91.45 |

| 2025 | 21,946 | 111.29 |

These numbers show that the bank has grown in terms of both revenue and profit.

Income Statement: Interest & Profit Growth

- Interest Earned rose from Rs 15,836 crore in June 2024 to Rs 17,248 crore in June 2025.

- Total Expenditure also increased slightly from Rs 18,293 crore to Rs 19,329 crore.

- Despite the rise in interest income, higher expenses reduced net profit margins in the recent quarter.

Balance Sheet: Assets & Deposits Growth

Kotak Mahindra’s consolidated balance sheet shows strong growth over the years:

| Particulars | March 2021 | March 2025 |

|---|---|---|

| Total Assets | Rs 478,872 crore | Rs 879,774 crore |

| Deposits | Rs 278,871 crore | Rs 494,707 crore |

| Loans & Advances | Rs 252,188 crore | Rs 486,165 crore |

This highlights the bank’s expansion and growing market presence.

Cash Flow: Solid Operational Strength

The net cash flow from operating activities stood at:

- Rs 4,881 crore in March 2021

- Rs 16,915 crore in March 2025

This indicates better cash management and stronger operational results over the years.

Dividend and Corporate Actions

Kotak Mahindra declared a final dividend of Rs 2.50 per share on May 5, 2025, which became effective on July 18, 2025. The company also released its unaudited quarterly results and held an earnings conference call to update investors.

Market View and Ratios

As of July 25, 2025, financial analysts are showing a bearish sentiment on the stock, likely due to short-term profit decline. However, the long-term indicators remain positive:

- P/E Ratio: 19.51

- P/B Ratio: 2.74

- NIM: 4.25%

- ROE: 14.04%

Conclusion

While Kotak Mahindra Bank’s stock faced a steep fall recently, its overall financial position remains strong. The dip in quarterly profit has impacted investor confidence, but long-term growth in revenue, assets, and profitability shows that the bank continues to perform steadily. Investors may want to watch for upcoming quarters before making further decisions.

Also Read: IEX Share Price Falls 26% After Market Coupling News – Full Detail – FM News