Nestlé India Q1 Results: Profit Drops 13% Despite Strong Sales Growth; Manish Tiwary to Take Over as CMD

Nestlé India, one of India’s top FMCG (Fast-Moving Consumer Goods) companies, has reported its financial results for the quarter ending June 30, 2025 (Q1 FY26). While the company managed to grow its revenue by nearly 6%, its net profit fell by over 13% compared to the same quarter last year. The main reasons behind the lower earnings were rising costs, higher interest expenses, and inflation in key raw materials such as cocoa, coffee, and milk.

The company also announced a major leadership change. From August 1, 2025, Manish Tiwary will become the new Chairman and Managing Director (CMD) of Nestlé India, replacing Suresh Narayanan, who is retiring on July 31, 2025.

Let’s break down the key details of Nestlé India’s Q1 performance, financial figures, and what lies ahead for the company.

Revenue Grows but Profit Takes a Hit

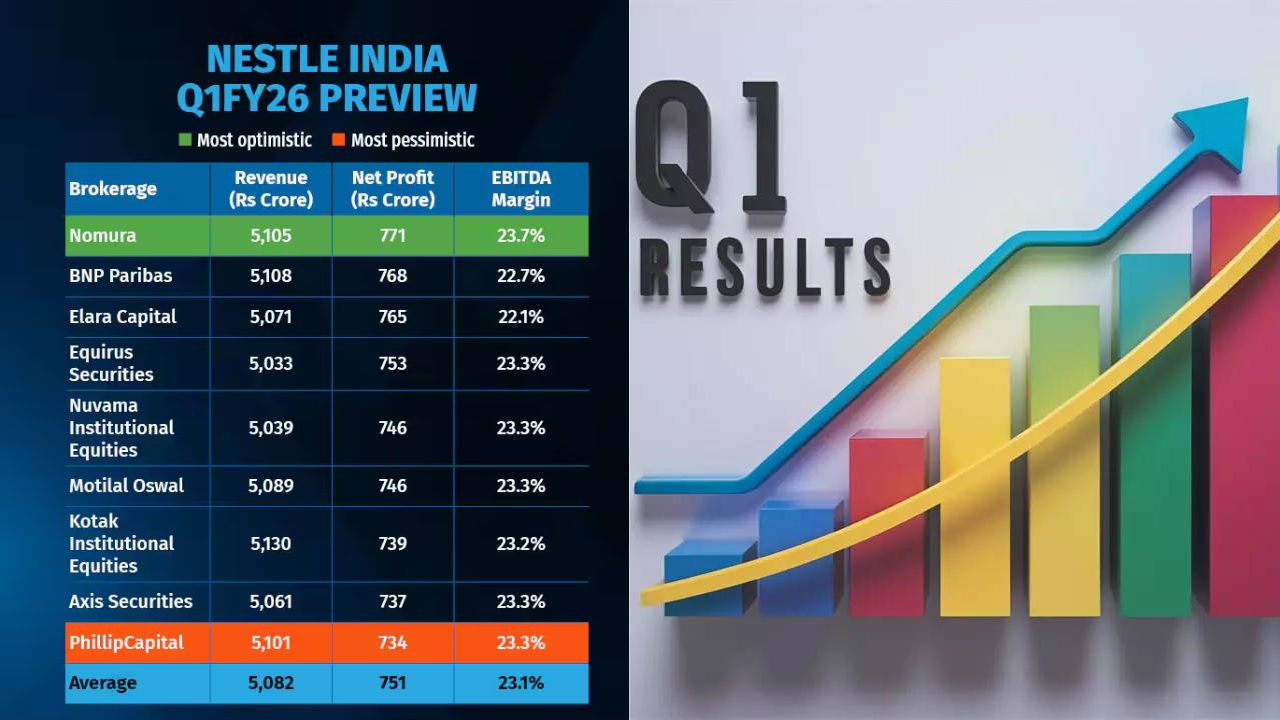

For the April-June quarter, Nestlé India reported a revenue of ₹5,096 crore, marking a 5.9% increase compared to ₹4,810 crore in the same quarter last year. This was in line with market expectations, as analysts had estimated revenues to be around ₹5,080 crore.

However, the company’s net profit fell to ₹646.6 crore, which is 13.4% lower than the ₹746.6 crore it earned in the same period last year. The profit also missed analyst expectations, which were around ₹732 crore, according to a CNBC-TV18 poll.

On a standalone basis, the net profit stood at ₹659.2 crore, down 11% year-on-year.

EBITDA Margin Contracts Due to Rising Costs

Nestlé India’s Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) for the quarter was ₹1,100 crore-flat compared to last year, and slightly below market estimates of ₹1,135 crore.

More importantly, the company’s EBITDA margin dropped to 21.6%, down from 22.9% in the previous year. This decline was mainly due to:

- Higher input costs in raw materials like cocoa and milk

- Increase in finance costs due to short-term borrowings from banks

- Expansion-related operating costs

The company said it had borrowed funds from commercial banks to support operational cash flow needs, which resulted in higher interest payments during the quarter.

Commodity Prices a Key Challenge

Nestlé India Chairman Suresh Narayanan highlighted that the company faced elevated consumption prices across many commodities during the quarter. Items like cocoa and coffee, used in products such as KitKat and Nescafé, saw steep price rises.

However, the company also noted a stabilisation in edible oil and cocoa prices, along with a decline in coffee prices. Milk prices are expected to decrease further with the arrival of the monsoon season, offering some relief in the coming quarters.

Volume Growth at 3%, Urban and RUrban Markets Perform Well

Despite cost pressures, Nestlé India reported 3% volume growth in the domestic market. This was at the upper end of market expectations, which had predicted growth between 2% and 3%.

The company said it saw strong double-digit growth in several product categories, such as:

- Confectionery (led by KitKat)

- Prepared dishes and cooking aids

- Powdered and liquid beverages (led by Nescafé)

Nestlé said urban demand continues to rise, while RUrban (rural + urban mix) markets are also showing positive trends. This is a sign that consumer sentiment may be improving despite higher food prices.

Pet Food Segment Also Grows

Nestlé’s recently launched pet food division performed well during the quarter. The cat food portfolio especially showed strong growth, adding another revenue stream for the company. Nestlé is looking to diversify further into new categories to support long-term growth.

Leadership Transition: Manish Tiwary to Become CMD

A major development this quarter is the appointment of Manish Tiwary as the new Chairman and Managing Director of Nestlé India. He will officially take charge on August 1, 2025.

Manish Tiwary has held leadership roles at Amazon India and is expected to bring fresh strategies to Nestlé during a time when most FMCG companies are seeing slow growth and rising investor pressure.

Outgoing CMD Suresh Narayanan will retire on July 31, 2025, after serving the company for several years and leading it through critical phases of transformation and growth.

Stock Market Reaction: Share Price Falls 5%

After the results were announced, Nestlé India’s share price fell by over 5%, closing at ₹2,326 on the NSE. It became one of the top losers on the Nifty 50 index for the day.

The fall was driven by the profit miss, rising costs, and margin pressure. However, many analysts believe that the long-term fundamentals remain strong, especially if commodity prices ease in the upcoming quarters.

What Lies Ahead for Nestlé India?

Looking ahead, Nestlé India has a few challenges and opportunities:

- Cost pressures may ease with falling milk and coffee prices

- Urban and semi-urban demand is rising, giving hope for volume-led growth

- New leadership under Manish Tiwary may bring in strategic innovations

- Expansion in pet care and nutrition categories could fuel future earnings

The company continues to focus on innovation, rural reach, and operational efficiencies to protect its margins.

Conclusion

Nestlé India’s Q1 results show a mixed performance – with solid sales growth but weaker profit margins due to rising costs. While the profit decline and margin pressure raised short-term concerns, the company’s strong brand portfolio, growing rural demand, and leadership transition offer reasons to remain optimistic about the future.

As cost pressures ease and expansion efforts stabilize, Nestlé India may be better positioned for recovery in the second half of the year.

Also Read: IEX Share Price Falls 26% After Market Coupling News – Full Detail – FM News